The Challenge of Falling Grocery Inflation for Suppliers

Both Coles and Woolworths released their FY24 results last week and, while there has been much discussion about the headline sales and profit results, the numbers that caught my eye were the grocery inflation figures that Coles reported.

Shelf prices increased by 1.5% p.a. in the second half of FY24, down from 2.9% in the first half and a whopping 6.9% in FY23.

While this is making it difficult for suppliers to justify price increases, the good news is that lower commodity prices and an improving labour market will help ease margin pressure.

Both Coles and Woolworths released their FY24 results this week and, while there has been much discussion about the headline sales and profit results, the numbers that caught my eye were the grocery inflation figures that Coles reported.

Shelf prices increased at a rate of only 1.5% p.a. in the second half of FY24, down from 2.9% in the first half and a whopping 6.9% in FY23. This is a dramatic turnaround from where we were a year ago. Given the trajectory, and easing cost pressures, I wouldn’t be surprised to see the next half’s grocery inflation number come in below 1%.

Changes in retail prices are a direct result of changes in manufacturer sell prices. So falling inflation means that retailers are accepting fewer and smaller cost increases from suppliers that they were the previous year. This trend will continue over the next 12 months, particularly with lower commodity prices and increasing labour availability easing cost pressure for producers.

Coles Retail Price Inflation

Source: Coles Annual Reports

Decreasing Commodity Prices

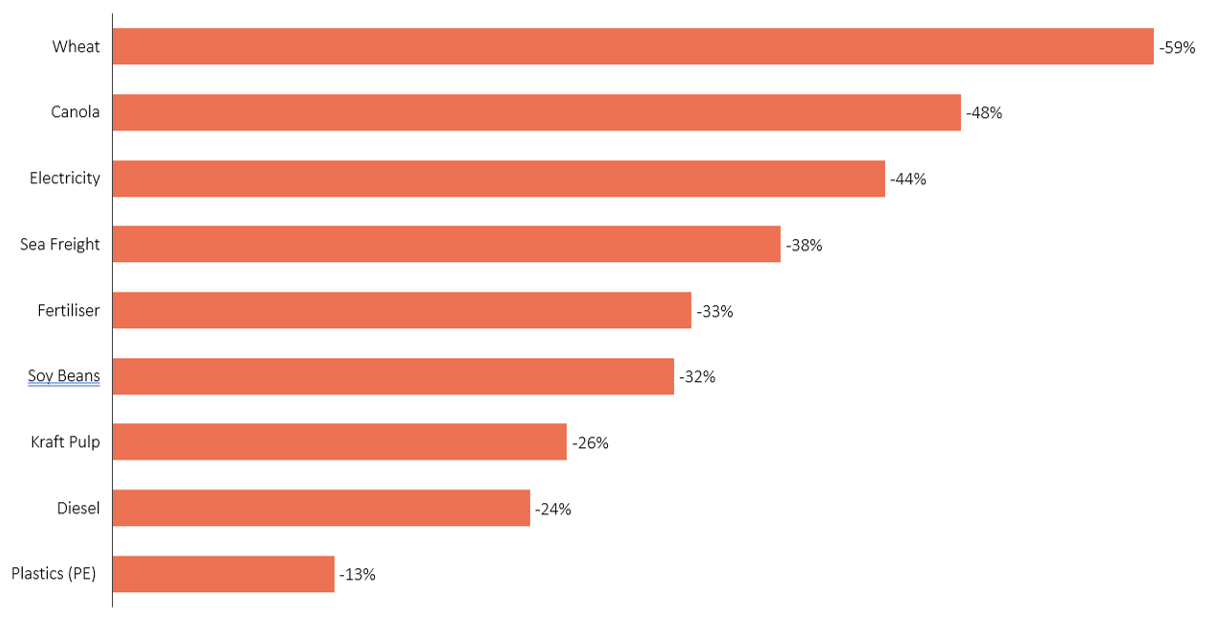

The good news for producers is that the prices of almost all major soft commodities have fallen dramatically since their peak in FY23, including wheat and grains, electricity, sea freight, fertiliser, plastics, cardboard and diesel.

This will go a long way towards easing margin and cost pressures for producers. However, falling commodity price indexes don’t always translate automatically to cost reductions. Suppliers of key inputs to food manufacturing, such as packaging, ingredients or transport tend not to offer cost reductions off their own bat. Like any other business, they look to maintain prices and margins as long as they can and will only pass through cost reductions when they are pushed to do so.

This is where Procurement comes in. A comprehensive sourcing program that introduces competitive tension via a rigorous, structured RFP process is the most effective way to reduce the cost of key inputs and to maximise the benefit of falling commodity prices. We’ll cover this topic more in a later article.

Commodity Price Decreases from FY23 Peak

Sources: Chicago Board of Trade, ICE Futures Canada, Australian Eastern Young Cattle Indicator, Global container freight rate index, DAP Spot Price US Gulf, Global Dairy Trade, Diesel Terminal Gate Prices

Improving Labour Supply

The other area we’ve taken a look at is labour rates and supply. Many food and agribusinesses have struggled with labour shortages over the last few years. It has been difficult to attract and retain skilled staff, particularly in regional remote areas. Consequently, companies have been holding onto any excess staff that they do have, or haven’t focused as closely on efficiency and labour optimisation as they typically would. This, along with a strong economy, has resulted in a surge in demand for labour and significant increases in cost.

The good news is that, after flat lining for several years, the total labour market has increased by 1.2m workers (9%) in the last two and a bit years. With increasing supply and more competition for available jobs, labour cost pressures will moderate this financial year.

Total Australian Labour Force (Million Persons)

Source: ABS 6291.0.55.001 Labour Force, Australia

In summary, food and grocery inflation is falling rapidly, making it difficult for suppliers to justify price increases. But lower commodity prices and an improving labour market will allow companies to reduce costs and maintain their margins.

Transformation through simplification

Simpler food and beverage businesses can be easier to operate, more efficient and more profitable.

But is simplification always possible? And how do you go about simplifying a complex business? In this article, we will provide answers to these questions and provide a roadmap for transforming your business through simplification.

Simple - or simplified - food and beverage businesses can be:

● Easier to operate

● More efficient

● More profitable

But is simplification always possible? And how do you go about simplifying a complex business? In this article, we will provide answers to these questions.

Consider these two food manufacturers. Both operate in similar categories and have roughly the same revenue, but markedly different profitability.

Complex Foods produces $110m of revenue from 256 SKUs and nine production processes. While Simple Sugars produces almost the same revenue from much less SKUs and only two production processes.

Yet, Complex Carbohydrates has an EBIT of $ 1.3 million while Simple Sugars has an EBIT margin of $ 6.3 million. An almost five-fold difference.

If we asked which one you’d prefer to run, the answer would be obvious: Simple Sugars. Fewer products, pack formats and customers would make it easier to operate - and its far more profitable.

But, if this is the case, why are so many companies more like 'Complex Carbohydrates' than 'Simple Sugars'?

Why are more complex businesses usually less profitable?

And how can you transform a 'Complex Carbohydrates' company into a 'Simple Sugars'?

Lets start with the first question first.

Why are so many food companies so complex?

Companies usually start out narrow and focused. They have one great idea, maybe a few product variants and a single production line. They sell this into a handful of customers. And life is easy (well not really, but relatively speaking)

Over time though, they feel the need to keep growing. Why? To achieve greater scale and larger profits. This makes sense. Greater volumes mean greater buying power so lower input costs. Longer production runs mean increased production efficiency. And bigger orders mean full trucks so lower transport costs. Right?

But this only works if you are selling more of the same products through the same sales channels. What we often see is companies struggling to grow their core offering after a period of time. Often because they haven’t invested enough in marketing and brand building, so they are struggling to reach more end consumers (Hello Mark Ritson!)

And when this happens, they try to grow by expanding and diversifying. They develop new products, they create new brands, they enter new categories, they expand geographically and into new sales channels.

And the result of this is increased complexity. More products means more R&D, more production lines to run and maintain, more ingredients and packaging to source. More brands means more marketing campaigns. More customers means more sales reps and more administration. And more geographies means more distribution centres and delivery vans. The business becomes very complex very quickly.

Why does more complexity equal less profitability?

When we think about the above, it is obvious that more of everything means more cost. Which isn’t a problem as long as revenue growth is strong. If the company was generating $10m in revenue per product previously, and each new product continued to generate $10m, then the additional income can fund the additional resources and activities required. And the same with customers – if each new customer is worth the same as the last all is well.

However, this is typically not the case. The next new range or product isn’t as successful as the original. New brands don’t work as well because they aren’t given the time and investment they need. Sales teams chase more and more marginal customers.

So average revenue per SKU/brand/customer all begin declining. And what’s worse, the growth that is achieved can often cannibalise existing volumes. So, you get increased complexity for little revenue growth. And you haven’t achieved any scale benefits because you’re not increasing utilisation of your existing assets, processes or overheads.

You end up with slowly growing revenues, rapidly growing costs and losing profitability.

Case Study: The Profit-Sapping Effect of Complex Business Operations

Take the example of one of our recent clients.

This client started out with a single-site operation. From here, they produced three products in two different pack formats which were sold to a single customer. They maintained this model for over five years. Over time, they added several new variants and handful of new customers. But they kept a laser focus on doing what they did well. The business generated decent revenues. It was efficient and had low overheads. What's more, it was very profitable.

But at about the 5-year mark, growth slowed, and the business began looking for new sources of growth.

Over the next few years, the business added thirty new products and two new pack formats. It added a second production site to increase its geographic reach. And it began selling direct to food service and independent supermarkets, adding 120 new customers in the process.

While revenues almost doubled during this time…

Costs more than doubled.

And profits fell from a healthy ~11% margin to negative 2% and falling.

By the 10-year mark, most of the original management team had left the business, taking the institutional knowledge that made the company successful with them.

This is when a new management team approached us to help them rebuild and refocus the company.

The 80/20 rule in action: our client’s three original products generated – by a wide margin – the highest revenue. The 30 new products that added complexity were significantly lower in revenue

How can you transform a complex, unprofitable food manufacturer into a simpler, more profitable one?

Time and again we have worked on cost transformation programs where simplification was out of scope or not seriously considered by the business. This would have a major impact on the benefits that could be achieved.

Simplification involves taking some big decisions. And it can mean significant change to a business, which carries risk.

Despite this, we believe that simplification is very doable. It needs clear leadership and a meaningful reason to change. With these things in place there is the potential to transform your business.

There are four key steps to delivering transformation through simplification

1. Understand the true profitability of each product, channel, geography, and customer.

2. Design a radically simplified product range. One aligned to the needs of only the most profitable customers and channels.

3. Use a clean sheet approach to redesign end to end operations and reset the cost base in order to realise simplification benefits.

4. Establish a strong PMO or transformation office to deliver the change.

We will cover each of these steps in more detail in future articles.

In the meantime, if you would like to discuss how you can simplify your business, feel free to contact me on:

+61 408 995 207

Or email me at peter.cook@westbournefoods.com.au

Peter Cook

Founder and Director

Three levers for rapid cost reduction

Over the past 12-months, operating conditions in the food and beverages sector have been challenging. Consumer demand has softened, borrowing costs remain high and retailers are pushing back against price increases.

Sadly, we are seeing more food and beverage companies tipped into voluntary administration as a result of these challenges.

As a result of this, many in the industry are asking what they need to do to avoid a similar fate.

With price increases mostly off the table, and limited growth, the main option is to focus on cost.

In the hope it might benefit your business - we would like to share our approach to rapid cost reduction.

Over the past 12-months, operating conditions in the food and beverages sector have been challenging. Consumer demand has softened. Borrowing costs remain high.

And retailers are pushing back against price increases.

Sadly, we are seeing more food and beverage companies tipped into voluntary administration as a result of these challenges. With many high-profile casualties on this list, including Sara Lee, HS Fresh Food, Proform Foods, Australian Plant Proteins and others.

As a result of this, many in the industry are asking what they need to do to avoid a similar fate.

With price increases mostly off the table .…

And limited growth options .…

The main option is to focus on cost.

In the hope it might benefit your business - we would like to share our approach to rapid cost reduction.

We recommend food and beverage manufacturers focus on three key areas:

Reducing input costs

Using labour more efficiently

Optimising the supply chain

Let’s look at these in more detail, one by one…

Input Costs

Input costs consist of raw materials and packaging. These costs often make up 50% - or more - of a food manufacturer's cost base. So, this is where we typically start when looking for cost savings. The two approaches we use are:

1. Product redesign – can we change product formulations or packaging designs to reduce costs? For example, can we substitute ingredients? Or reduce the amounts of high-cost ingredients used? Or remove unnecessary packaging? All these changes can deliver benefits. The key is to do this in a structured way, by putting effective testing and controls in place. This will ensure quality—and consumer perceptions—are not affected.

2. Strategic sourcing – this is almost always a 'go-to' for input cost reduction. Optimising product specifications, introducing competitive tension and running a rigorous, structured RFP process consistently delivery benefits.

Over the past two years the prices of grain, proteins, cardboard, plastics and other commodities have fallen dramatically, leading to good savings on raw materials and packaging for those that have gone to market.

What's more, sourcing can be done in a short timeframe to quickly realise benefits.

Labour Efficiency

Large improvements in labour efficiency often come from capital intensive automation projects. But in a world of high interest rates, slowing growth and shrinking margins many companies do not have the capital to invest in automation.

There are, however, several levers companies can pull to improve labour efficiency without the need for CAPEX. They include:

Labour mix – Align the mix of casual and permanent labour to demand patterns. This delivers benefits by reducing reliance on expensive casuals or by avoiding over staffing during quiet periods.

Rostering and scheduling – Optimisation of shift structures to better align with production volumes can increase available production time and reduce overtime cost, while also avoiding unnecessary penalties.

Manufacturing efficiency – Broad and unfocused lean programs can be slow and of questionable benefit. In contrast, a targeted focus on specific improvements can yield significant benefits.

Increase line speeds. On many occasions, we have seen a production line running at a certain speed because “that’s the way it’s always been run”. Or because it’s the manufacturer's specification. An alternative approach? With engineering support and safety assessments, increase the line speed by half a percent and monitor the impact. Then keep increasing speed bit by bit until you start running into issues. This can ‘flush out’ the next round of maintenance fixes to let the line to run faster again. Over the years, this approach has consistently delivered 5–10% increases in line speeds for us.

Eliminate causes of downtime – log and categorise all downtime events. Then form a multifunctional team to work through the issues one by one, starting with the largest. Bring in external technical support if the plant team can't fix these issues.

Reduce changeover time – run rapid changeover projects on key lines and equipment. Using this approach, we’ve seen changeover times reduced by more than half. This has increased production uptime - and added planning and scheduling flexibility.

Introduce visual management – measuring OEE and downtime is key. Making the results visual on the shop floor is an effective way to drive improvement, ensuring focus and quick resolution of issues.

Supply Chain Optimisation

Freight and logistics costs tend to make up 10% – 15% of a company’s cost base. These costs have increased significantly in recent years. In large part, because of labour and capacity shortages in the industry.

The recent good news? Labour shortages have improved. And excess capacity- for both warehouse space and transport—is opening up.

There are two ways companies can quickly drive down supply chain costs. They are (1) to increase utilisation and (2) to tender your transport requirements.

Increase utilisation – companies can take many actions to increase utilisation and transport efficiency. They can reduce delivery frequency and increase MOQs, resulting in larger orders delivered less often. This has a major impact on transport costs and, often, only a minor impact on customers. Likewise, switching from own fleet to more efficient 3rd party providers for low volume, low density runs will deliver cost savings.

Tender requirements – for the first time in years, excess capacity is opening up. Which means now is a good time to tender your transport requirements. While this can be a complex project that carries some risk, we recommend breaking it up into manageable pieces. For example, sourcing key metro to metro lanes first. Followed by regional runs, or separating linehaul from last mile.

That, for now, is where we recommend you start your cost cutting efforts. By reviewing your input, labour, and supply chain costs.

Once you’ve done this, the other cost base areas worth reviewing are overheads and SG&A. A subject we will cover in another article.

In the meantime, if you would like to uncover how and where your business can optimise cost, please contact me for an initial, informal discussion.

You can reach me on +61 408 995 207 or at peter.cook@westbournefoods.com.au

Peter Cook

Founder and Director

Westbourne Food and Agriculture